Why Aussies in SMSFs are 3x wealthier than those in Big Super?

Tobias Fellas

March 6, 2024

In this deep dive analysis, we investigate the disparity between SMSF and APRA-regulated super funds retirement wealth (retail and industry super funds) and why that is.

Recent data released by

APRA showcases that Australia’s total superannuation assets are now

$3.7 trillion.

With a net increase of 22,000 SMSFs in 2023 that now account for a total of 610,000 funds controlling approximately

$913 billion in super assets.

SMSFs account for only 4.6% of Australia's super total super accounts but is now controlling 25% of retirement wealth in Australia.

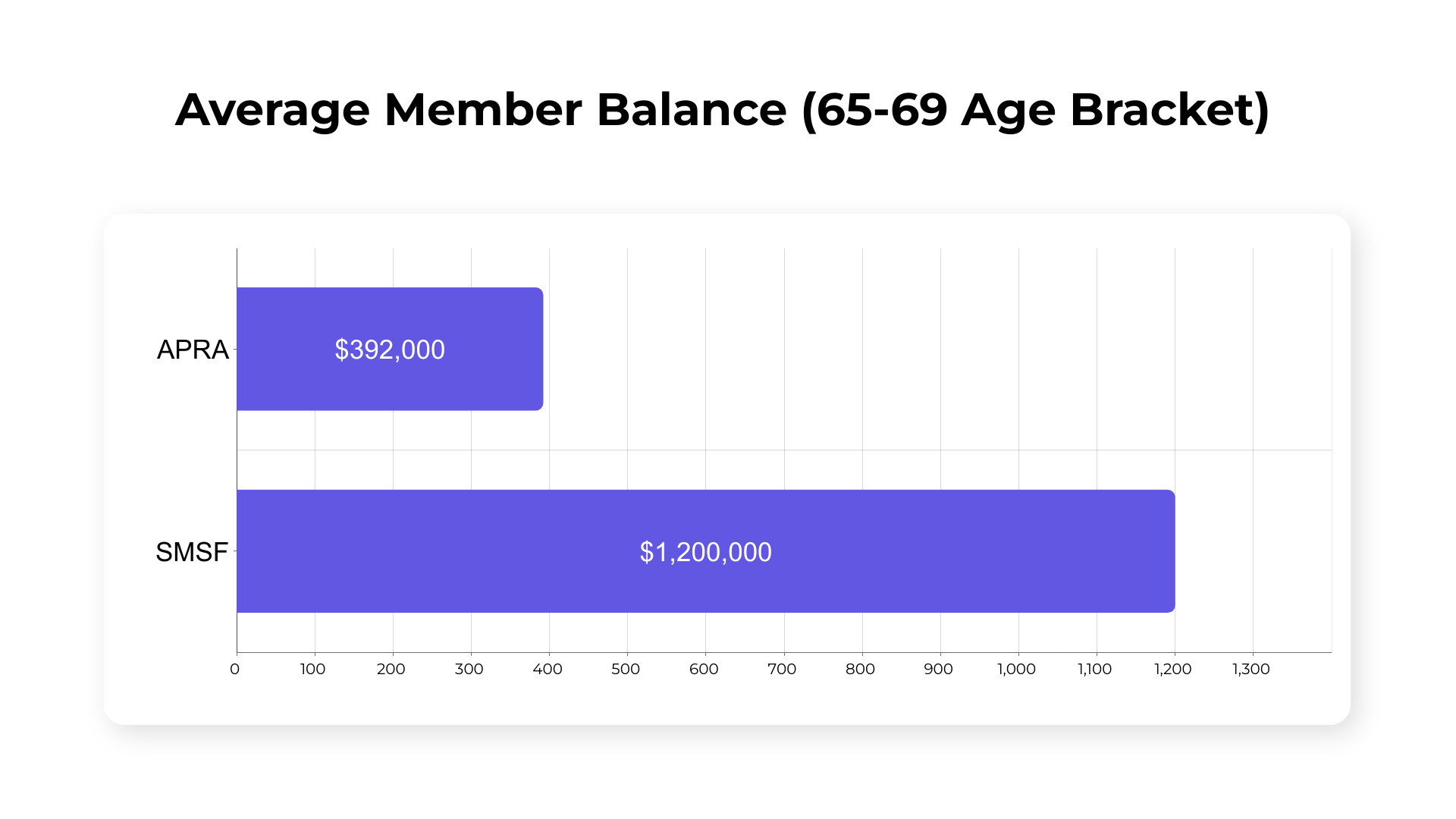

Digging deeper in the data, we compare the average member balances of a member in an SMSF and member in APRA fund.

In Class 2023 benchmark report, their data indicates an average SMSF member balance within the 65-69 age bracket is over $1.2 million.

Now, compare this to APRA-regulated funds. Members of the same age group, 65-69, have an average member balance of $392,000. SMSFs are now astonishingly 3x larger than their APRA counterpart.

While there is a big disparity in wealth between SMSFs and APRA funds, there seems to be a much larger problem that is hidden deeper in the data.

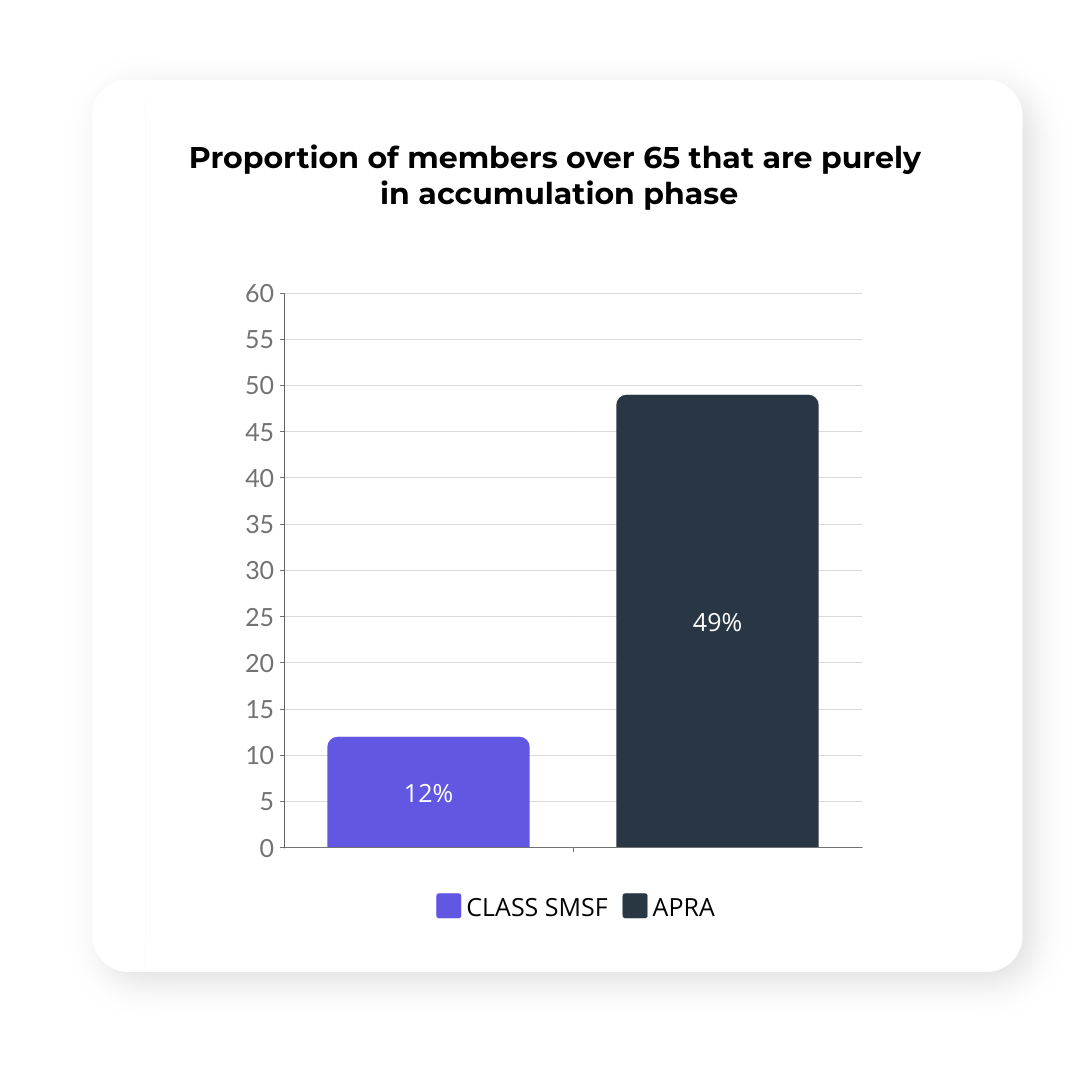

When we compare members at age 65 that have met a condition of release (i.e no cashing out restriction) of their super accumulated benefits between SMSF and APRA fund members, this where the data becomes quite divisive.

The data shows that 49% of APRA fund members over 65 are still purely in accumulation phase and have not commenced a retirement income stream despite meeting a condition of release.

Compared to 12% of Class SMSF members over 65 that are purely in accumulation.

What this data means is that APRA fund members are disproportionately leaving their retirement benefits in accumulation compared to Class SMSF members. We believe this is a function of APRA fund members fundamentally

not understanding their retirement options and leaving it in accumulation because it is safe

despite a need to access capital.

It seems that biggest reason why APRA fund members are less likely to draw a tax-free income stream in retirement compared to the equivalent SMSF members is that the APRA funds themselves (the trustees) are not giving their members enough information or access to financial advice to make decisions about their retirement.

ASIC commented on this and said while RSE’s “were focusing most of their efforts on expanding support available to members in or approaching retirement… overall, there was a lack of progress and insufficient urgency … to improve member’s retirement outcomes.”

Why there is a disparity between APRA and SMSF members

We believe that SMSF trustees have better retirement outcomes given that they have access to a larger network of professionals not out of their volition but mainly out of upfront and ongoing trustee responsibilities. There are ongoing SMSF trustee responsibilities and obligations that an APRA fund member will never have.

Financial advisors are now required to provide SMSF suitability and establishment advice before setting up a fund. Coupled with the annual tax return obligations prepared by an accountant or SMSF administrator, there are a variety of professional conversations that a trustee must engage in and act on each year.

It’s arguable that given that APRA fund administration is organised in such a way to streamline the process, they have cut out the member engagement piece in which a member will never ask about their super fund strategy because a conversation will never be had.

Frankly, this is not the APRA funds fault. It cannot be their responsibility to ensure that members are interested in their retirement outcomes. However, they should be required to provide resources to the member when they reach a retirement milestone and showcase basic options available to the member.

And here we are. At the foothills of the next big issue.

Should super funds be able to give general advice to their members?

Tobias Fellas

Founder & Partner

Felcorp Support

0401 050 537

tobiasfellas@felcorp.com.au

We’re seeing firms sink or swim. The reality is that not all firms are suitable for offshore outsourcing whether too small or too disorganised. It’s quite sad that as we follow up on these firms periodically, we see they are in no better shape and eventually sell out their practice much lower than they ever participated. Our goal is to change this.

Send us a message

Contact Us

We will get back to you as soon as possible

Please try again later

We're humans too.

Give us a call or email us directly

Tobias Fellas (director)

Mob: 0401 050 537

Email: tobias.fellas@felcorp.com

L36, 1 Macquarie Pl

Sydney NSW 2000 (by appointment only)

More about Felcorp Support

What offshore staff we provide

0401 050 537

tobias.fellas@felcorp.com

© Felcorp Support | All rights reserved

Felcorp Support is an independent outsourcing staff supplier. All staff are employees of Felcorp Support and are not affiliated or in partnership with any other business outside the Felcorp Group. We do not have any professional services licences or registrations and never purport to have any of these professional registrations.