USA v Australia: How the advice industry stacks up

Tobias Fellas

January 30, 2024

While the data shows Australian advisers are significantly underrepresented in professional services compared to the USA, there is a unique convergence of events that Australian financial advisers can capitalise on to grow their business.

Data from the US industry of Financial Advisory provided by Statista shows an interesting picture of the advisor landscape in the US. Critically, when comparing the US data back here in Australia, one may look at our data is particularly bleak.

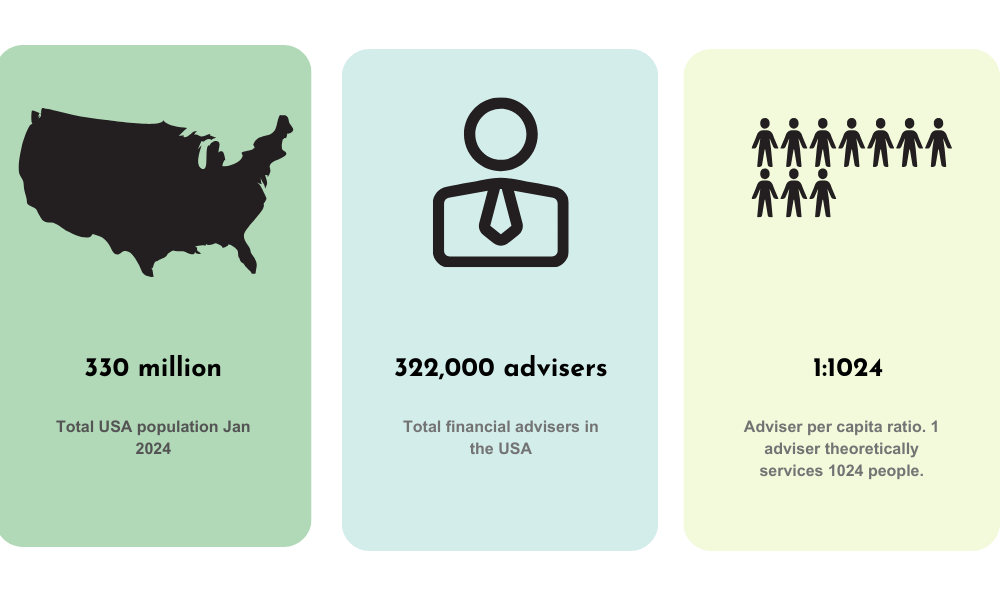

In 2024, the estimated total

number of

USA financial advisers is 322,000. With a total population of 330 million, the

adviser per capita ratio is 1:1024 for the US population.

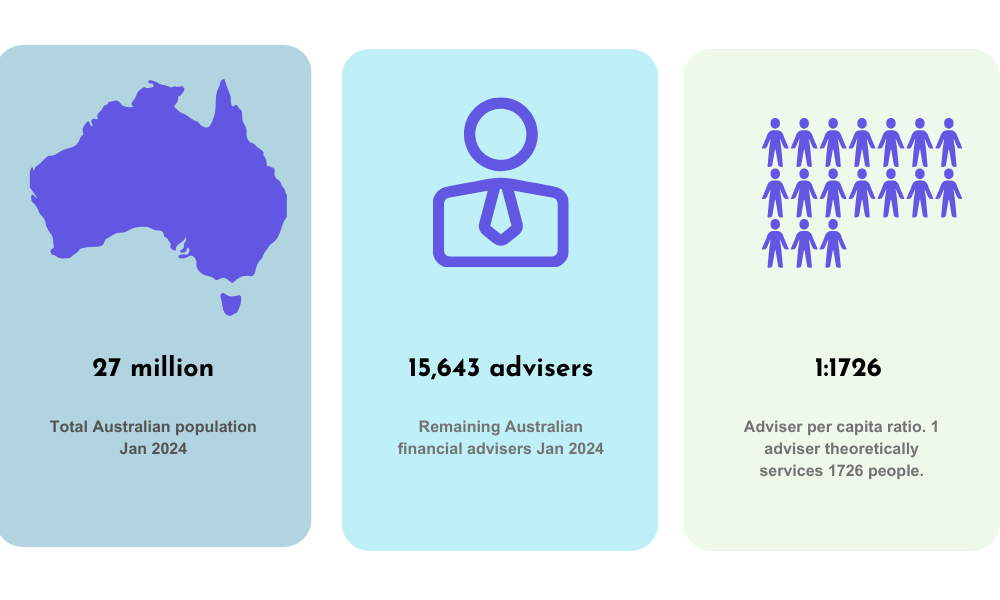

Now compare this data to Australia. There are 15,643 remaining registered financial advisors as of January 2024 with a total population of 27 million people at the same time.

This represents an adviser per capita ratio of 1:1726. This is a 68% increase compared to the US.

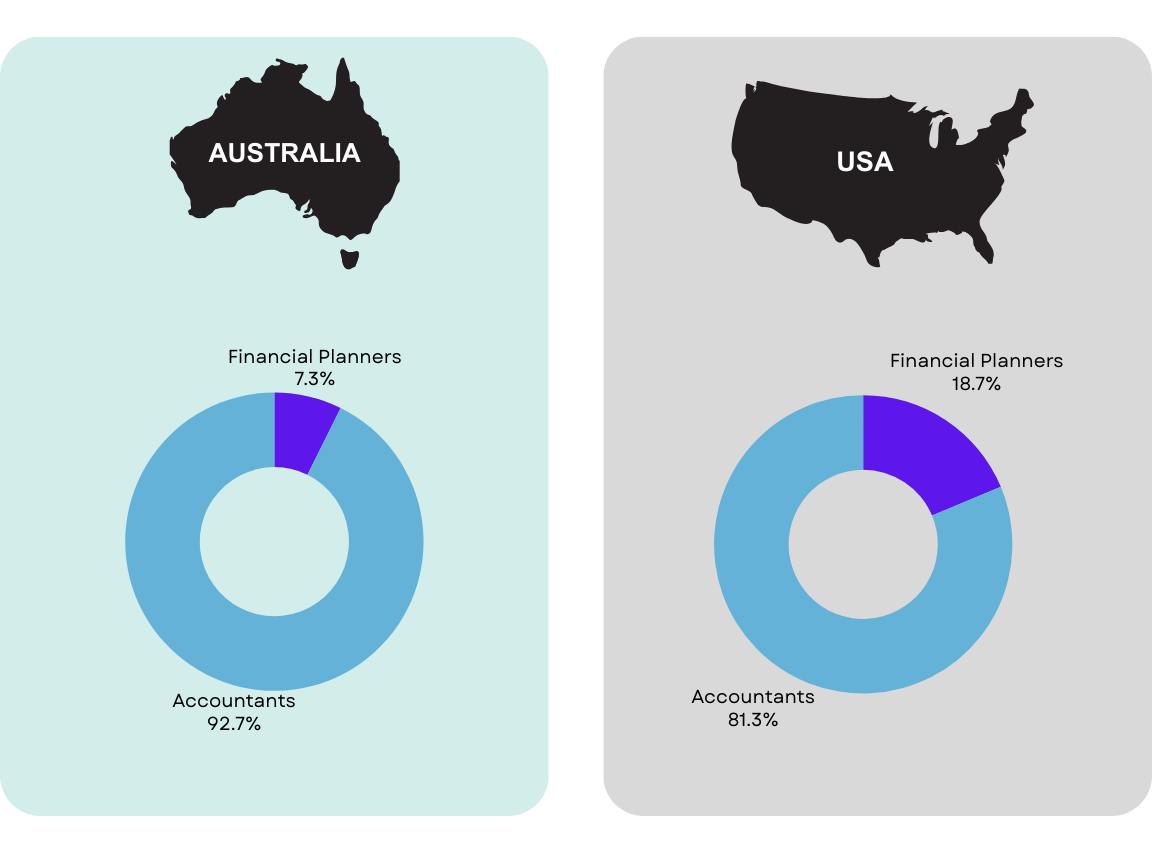

To make this data particularly interesting, we compared the ratio of financial advisors to accountants in Australia with USA.

US

Data from Statista, reiterates there are 1.4 million accountants (2022 most recent data) as well as the 322,000 financial advisers. Effectively there are 4 accountants for every financial adviser.

Australia

Data from Australian Government (Labour Insights), estimates that there are 198,000 accountants. With 15,643 financial advisers, this means there are 12.5 accountants for every financial advisor.

Comparing the data, it shows that Australian advisers are more than 3 times underrepresented compared to our US equivalent.

The opportunity – capture it before others do

While this data may seem particularly depressing on paper, when you look beyond the data, it represents a culmination of converging opportunities that the Americans could only dream about:

reducing adviser competition and massively increasing demand for advice.

The convergence of an ageing population with an ever-increasing investable funds portfolio exacerbated by the huge decline of adviser numbers results in two clear outcomes.

Either:

1. You will have a good business and earn a pretty decent income, or

2. You will have an incredibly successful business as you’ve geared up to properly take advantage of the favourable market conditions

We are seeing firms that never been so excited before. They seem to thrive on the pessimism of the financial planning industry.

While others moan and groan about the industry, these select few firms see the staffing challenges, the Quality of Advice Review, offshore outsourcing as an enormous opportunity to create a massively more scalable model when there is so much industry change.

These firms are making strides now while other firms and waiting to see what happens.

What’s holding advisers back

The key issues holding advisers back, in my opinion, is their strategic thinking on the following issues:

Staffing

While offshore outsourcing does have a natural limit of capability of providing advice, the ability for firms to move existing staff into adviser roles and offshore outsource the rest of paraplanning and administrative staff is the clear way to go.

While I’m of course biased writing about the successes of offshore outsourcing, objectively speaking, all the firms that utilise offshore outsourcing regardless of using Felcorp services are significantly more profitable, more stable and I’ll go so far to say are happier.

Process Efficiency

Utilising the right software piece in combination with a scalable and streamlined advice process is what sets up firms for long term business growth. We are currently helping our network of advisers to simplify their advice process to purposefully carve out roles for their onshore team to be as client facing as possible and our offshore team to be doing as much back office as possible.

Compliance

Compliance seems to be misunderstood at the moment. The QAR is a pathway to less red tape but it’s not a hall pass. As a result, many advisers have continued plodding along for the past 5 years with no real change to their plans. A wait and see approach…

Contradictory to what many advisors think, compliance is here to actually make your advice documents and your process less rigorous. Sean Graham, recently wrote an article for us stating that 2023 data highlights an increased adviser focus on process compared to 2022 that was more focused on product-driven advice. This was an evident shift with our firms that we similarly noticed too.

What’s clear is that advisers need to shift their focus to work with compliance in a proactive way to authenticate their future advice process rather than to drive blind. Compliance has traditionally been retro-active, punishing you for past mistakes rather than preventing them.

Here is the opportunity to utilise compliance to drive forward-looking advice processes.

Devil is in the data

The data between US and Australia is incredibly interesting. Australian financial advisors are proper battlers. While the data looks grim for those looking in, for us in the mix of it, the opportunities are ripe for those that take a chance.

I’ve personally never been so excited for the future of the financial planning industry. I only wish I come across more like-minded individuals that share my passion of overcoming issues and exploiting opportunities.

Tobias Fellas

Founder & Partner

Felcorp Support

0401 050 537

tobiasfellas@felcorp.com.au

We’re seeing firms sink or swim. The reality is that not all firms are suitable for offshore outsourcing whether too small or too disorganised. It’s quite sad that as we follow up on these firms periodically, we see they are in no better shape and eventually sell out their practice much lower than they ever participated. Our goal is to change this.

Send us a message

Contact Us

We will get back to you as soon as possible

Please try again later

We're humans too.

Give us a call or email us directly

Tobias Fellas (director)

Mob: 0401 050 537

Email: tobias.fellas@felcorp.com

L36, 1 Macquarie Pl

Sydney NSW 2000 (by appointment only)

More about Felcorp Support

What offshore staff we provide

0401 050 537

tobias.fellas@felcorp.com

© Felcorp Support | All rights reserved

Felcorp Support is an independent outsourcing staff supplier. All staff are employees of Felcorp Support and are not affiliated or in partnership with any other business outside the Felcorp Group. We do not have any professional services licences or registrations and never purport to have any of these professional registrations.