There isn’t a talent shortage, there is an abundance of opportunity

Tobias Fellas

January 12, 2024

The skilled staffing shortage is a great opportunity to take advantage of the issues in the market and derive a strategic plan to get way in front of those that are not strategically-minded.

Overview

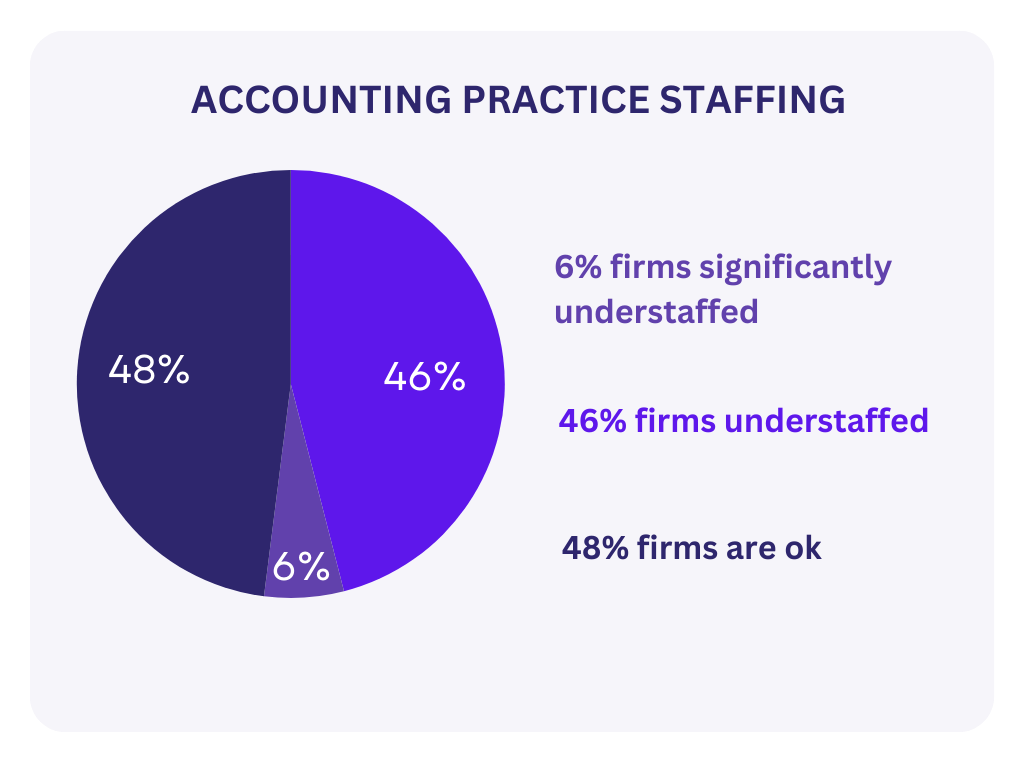

Skilled staffing issues is only going to get worse before it gets better. And it looks like staffing issues are going to persist for at least the next 3 years. 52% of Accounting practices are facing staffing issues with 6% facing significant understaffing.

The Australian Bureau of Statistics has indicated that Australia needs 30,000 accountants to enter the industry by 2026 to meet the demand. Intake of student accountants at universities has dropped and skilled visa migration pathways are continuing to be problematic as migrants are changing practices every 12 months.

The Reality:

The reality of the situation is that new entrants into the industry from either skilled migration visas or graduates are only going to make up a small portion of the demand.

What the likely outcome is going to be is that more firms are going to seek offshore outsourcing to replace that staffing gap.

David New, APAC lead at professional services platform Ignition said that outsourcing will have to make up for the shortage.

“The outlook for the front end of the talent pipeline is likely to get worse. As a result, more accounting firms may look overseas to countries with lower labour costs to find qualified staff.”

The Opportunity:

Offshore outsourcing is rarely seen an as an opportunity for practices. It is usually engaged as an alternative to onshore staffing issues. But there are some strategic firms that utilising this staffing shortage and offshore outsourcing to build their practices much faster than those that do not outsource.

Scenario 1 – Practice acquisition through vendor finance

John is utilising 2 Snr Felcorp offshore accountants in his practice and is seeking acquisition opportunities of a small firm from Amy with $400k revenue. Amy has never offshored yet despite having consistent internal staffing issues and needs staff. Amy is looking to retire early.

John submitted a proposal to Amy to engage a Snr Felcorp Accountant for the next 12 months before proceeding with the practice purchase. The aim is that when John purchases the practice in 12 months, the Felcorp offshore accountant becomes a bolt-on to his existing business as he now has a team of 3 offshore staff that are working to the same process with that 1 offshore staff member already familiar with Amy’s work.

John agreed to pay Amy in vendor finance over 2 years and keep her on in that transition period.

We see this as an incredibly smart strategic purchase plan, as the Felcorp Snr accountant provides both an immediate support to Amy’s practice but crucially 12 months process continuity when John purchased the business.

Scenario 2 - Utilise offshore outsourcing to generate partner and equity pathways

Greg is 1 of 3 partners at a regional NSW financial planning and accounting firm. Greg, like most firms, is facing issues of retaining skilled staff. They are growing their firm. Greg has 2 Snr Felcorp Paraplanners and 1 Felcorp admin staff doing the bulk of the back-office tasks.

Greg and the partners have decided to give their practice manager an equity pathway in the business to ensure that they retain him, offering him a partner designation after 12 months. He is tasked with specifically funnelling the work to the outsourcing team to ensure that the current partners are solely engaging in client revenue opportunities.

The cost savings of the offshore operation and availability of staff has enabled the partners to boost profits and deliver dividends to the partners as a remuneration incentive to continue growing the business.

This is a really good plan to retain key value staff. On top of this, Greg used the equity pathway as a tool to further increase the efficiency of the offshore outsourcing team so all the partners had skin in the game.

The Results:

There are those that do and those that do not. Unfortunately, the market is changing so quickly that those that do not are going to feel a lot pain and risk having a diminishing practice with an even smaller valuation.

We are already seeing the night and day differences with firms that have been working with Felcorp for the past 3 months compared to firms that have never offshored.

Those that don’t offshore seem to always be in a perpetual state of crisis management or stagnation with no real plans beyond the next 3 months.

To find out more how we can help, please download our case studies to the see value that we can achieve in your practice.

Tobias Fellas

Founder & Partner

Felcorp Support

0401 050 537

tobiasfellas@felcorp.com.au

We’re seeing firms sink or swim. The reality is that not all firms are suitable for offshore outsourcing whether too small or too disorganised. It’s quite sad that as we follow up on these firms periodically, we see they are in no better shape and eventually sell out their practice much lower than they ever participated. Our goal is to change this.

Send us a message

Contact Us

We will get back to you as soon as possible

Please try again later

We're humans too.

Give us a call or email us directly

Tobias Fellas (director)

Mob: 0401 050 537

Email: tobias.fellas@felcorp.com

L36, 1 Macquarie Pl

Sydney NSW 2000 (by appointment only)

More about Felcorp Support

What offshore staff we provide

0401 050 537

tobias.fellas@felcorp.com

© Felcorp Support | All rights reserved

Felcorp Support is an independent outsourcing staff supplier. All staff are employees of Felcorp Support and are not affiliated or in partnership with any other business outside the Felcorp Group. We do not have any professional services licences or registrations and never purport to have any of these professional registrations.